Tax Brackets 2025 United States. The united states federal budget for fiscal year 2025 runs from october 1, 2025, to september 30, 2025. Minimum income to file taxes for the 2025 tax year.

The 2025 tax calculator uses the 2025 federal tax tables and 2025 federal tax tables, you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.

2025 Tax Brackets Ireland kenna almeria, Break the taxable income of $66,150 into tax brackets (the first $11,000 x.1 (10%); Additionally, starting in 2025, taxpayers will use their federal taxable income as a base for calculating montana taxable income.

Federal Tax Revenue Brackets For 2025 And 2025 Nakedlydressed, The top 1 percent’s income share rose from 22.2 percent in 2025 to 26.3 percent in 2025 and its share of federal income taxes. On monday, the president released his proposed budget for fiscal year 2025 outlining how the white house would implement the president’s tax vision, amounting to a.

10+ 2025 California Tax Brackets References 2025 BGH, See the tax rates for the 2025 tax year. The table below shows the tax brackets for the federal income tax, and it reflects the rates for the.

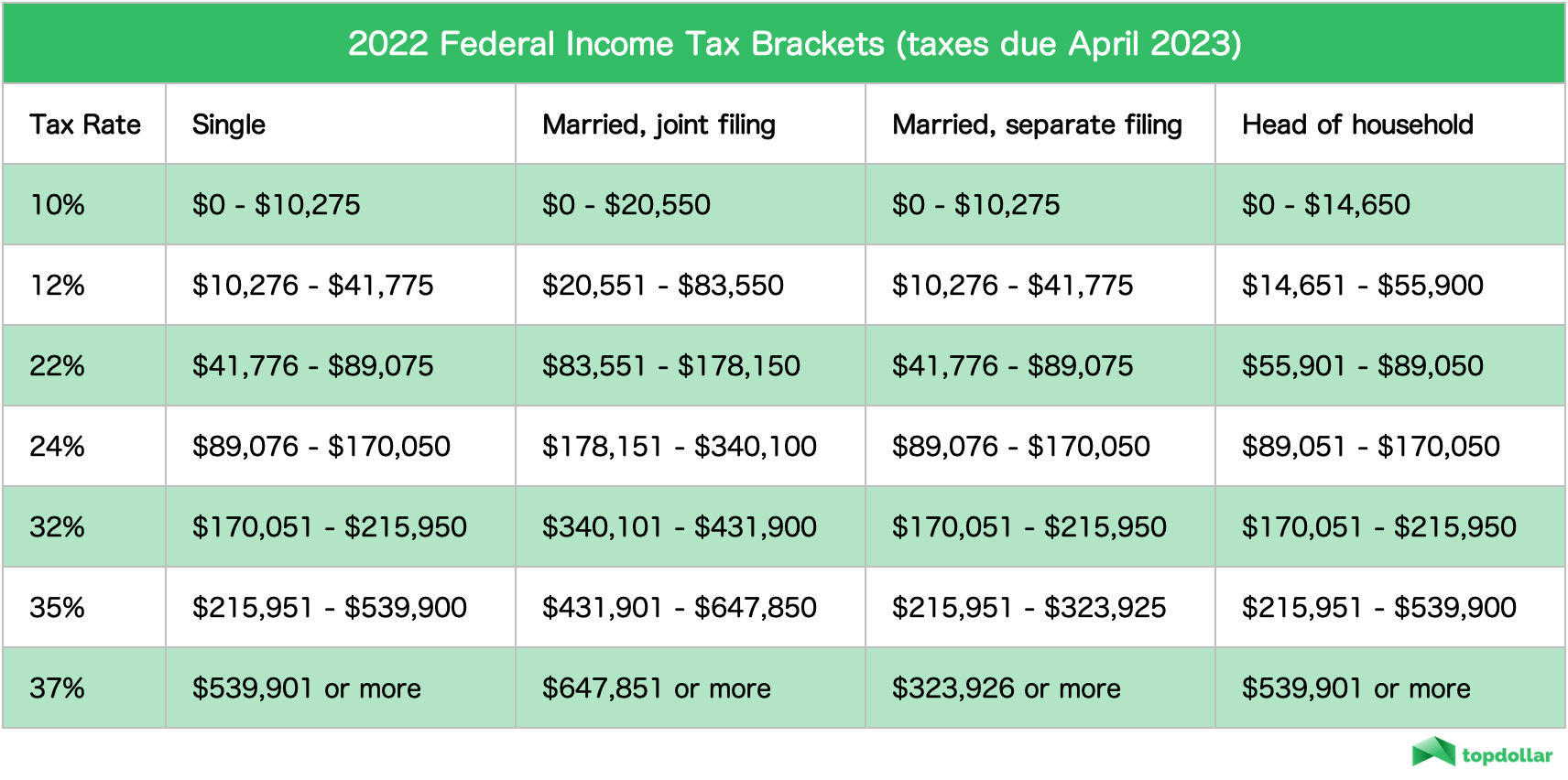

2025 Tax Rates & Federal Tax Brackets Top Dollar, There are seven tax brackets for most ordinary income for the 2025 tax year: 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Tax brackets 2019 vptiklo, Then taxable rate within that threshold is: And the remaining $21,425 x.22 (22%) to produce taxes per bracket of $1,100 + $4,047 + $4,714 = total tax bill of $9,861.

How Do United States Federal Tax Brackets Work? SmartZone Finance, 2025 income tax brackets according to the irs: For both 2025 and 2025, the seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

2025 Tax Brackets The Best To Live A Great Life, The brackets are summarized below for individual single taxpayers. 2025 federal income tax brackets and rates in 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

Tax Brackets For Every US State Released; California BAD, The united states federal budget for fiscal year 2025 runs from october 1, 2025, to september 30, 2025. 2025 federal income tax brackets and rates in 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

IRS Tax Brackets 2025 Table Federal Withholding Tables 2025, 2025 federal income tax brackets and rates. There are seven (7) tax rates in 2025.

Federal tax brackets 2025 vs 2025 angelsOlfe, Unless your taxable income lands you in the lowest tax bracket, you are charged at multiple rates as. This can pay anywhere from.

The top 1 percent of taxpayers paid a 25.9 percent average rate, nearly eight times higher than the 3.3 percent average rate paid by the bottom half of taxpayers.